Interview with Etienne Bossu, Chief Trading Officer at Electrum

Understanding the shift: what exchange rate and interest rate decoupling reveals

January 30, 2025

Reading time : 10 min

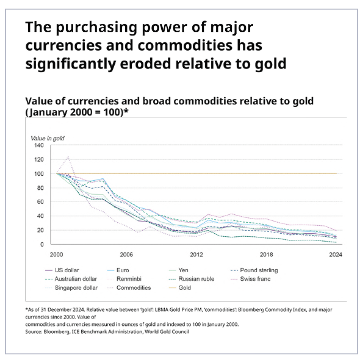

This decorrelation can be explained by investors’ growing mistrust in the ability of governments to return to a sustainable growth path without inflationary pressures or exploding public debt. While the dollar is doing well, the winner of this new paradigm is undoubtedly gold.

Financial markets are currently witnessing a complex and counter-intuitive dynamic: the rise in long-term interest rates in some countries is coinciding with a depreciation of their respective currencies. Traditionally, higher interest rates make bonds more attractive to foreign investors, which favors carry strategies and in turn increases demand for local currency. However, the current scenario seems to defy this logic in several geographical areas, where increases in long-term yields are translating into capital outflow on the part of international investors.

Sterling bears the brunt of international investor mistrust

What does this decorrelation mean? Take the pound sterling (GBP), for example, whose value has eroded against the dollar in recent months, despite less pronounced cut cycle forseen for the Bank of England’s key interest rate expectations and the resulting rise in long-term yields. This unusual dynamic may well be due to apprehension about the consequences of the broadly expansionary fiscal policy announced by the government at the end of last year. Investors fear that this policy will lead to a surge in inflation coupled with short-term support for growth, with no effect on long-term productivity or potential growth. This is a scenario that the Office for Budget Responsibility (OBR) has expressed concern about. International investors are therefore faced with a particularly bleak picture for the British economy, between sluggish long-term growth prospects, a never-ending rise in public debt and a more restrictive monetary policy in the years ahead. All of which will discourage carry strategies and weigh on the British currency.

Premium on political stability and fiscal discipline

Beyond this single case, it is the crisis of investor confidence in governments’ ability to return to a sustainable growth path without inflationary pressures or exploding public debt that explains the decorrelation between currency values and interest rate differentials.

This phenomenon has significant implications for investors and national economies alike. If a large number of countries face the same challenge, exchange rate trends reflect the relative attractiveness of different currencies, with investors placing a premium on political stability and fiscal discipline. And in this game, geopolitical tensions and economic uncertainties encourage investors to turn to safe-haven assets, even if it means assuming lower yields (CHF, JPY, Gold). This also explains the relative strength of the dollar, a benchmark currency whose appreciation over the past year is due more to its essential role in international trade and its overwhelming weight in the global economy than to its budgetary fundamentals, which are looking alarming under the new administration to say the least.

Gold more central than ever as a hedge against fiat currency devaluation

In any case, one of the big winners from this growing mistrust of governments by investors is undoubtedly gold. The rise in the dollar value of the precious metal, despite the fall in the US Treasury bond market at the end of last year, shows that the greenback is not immune to this crisis of confidence either. And this is far from the first time, as the World Gold Council noted in its report published on January 23: “fiat money can be printed in unlimited quantities to support monetary policy. This is clearly exemplified by the quantitative easing measures implemented in the aftermath of the Global Financial Crisis (GFC) and the COVID-19 pandemic. These crises saw many investors turn to gold to hedge themselves against currency devaluation and preserve their purchasing power over time “. It is not surprising that investors positioned to buy Gold on the futures market has reached record highs not seen since September 2024. The economic sequence that is about to unfold should, more than ever, confirm gold as the main defensive asset against inflationary pressures and the explosion in public debt.

Our Publications

Etienne Bossu, Chief Trading Officer at Electrum, talks to Véronique Riches-Flores, independent macroeconomist and former Chief Economist at SG CIB, about the global economic outlook and the new market paradigm. […]

EU Carbon Market 101The European Union Emissions Trading Scheme (EU ETS) is based on a cap-and-trade system: Operators of installations including power generation, various industries and intra-European aviation covered by […]