Interview with Etienne Bossu, Chief Trading Officer at Electrum

Crack spreads: lower for longer ?

December 17, 2024

Reading time : 10 min

Crack spreads (or « cracks ») refer to the differences between wholesale refined product prices (such as gasoline, diesel, jet fuel, fuel oil, etc..) and crude oil prices. Those spreads can be read two ways :

- On one hand : how profitable the refining industry is.

Cracks are closely monitored by market participants to have a sense of what gross refining margins look like, noting that they do not take into account all refinery product revenues and exclude refining costs other than the crude oil input. Some players keep their eyes on single-product cracks (for instance gasoline price minus crude price) and others watch multiple-product cracks, such as the standard « 3-2-1 » one (assuming 3 barrels of crude will be turned into 2 barrels of gasoline and 1 barrel of diesel, therefore approximating the typical product yield of a US refinery).

- On the other hand : how tight the product supply is.

Cracks can also be used to gauge the strength of end demand or the broad availability of petroleum products in general. The tighter a market is (i.e. deficit), the higher the price relative to crude – all else being equal.

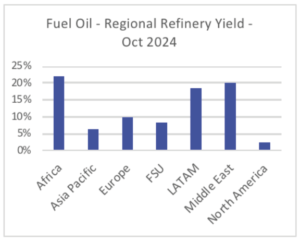

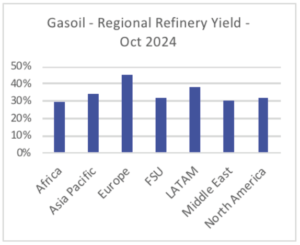

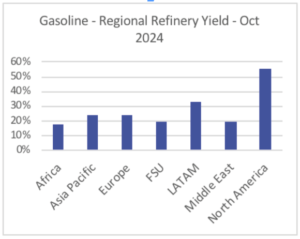

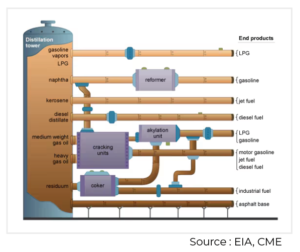

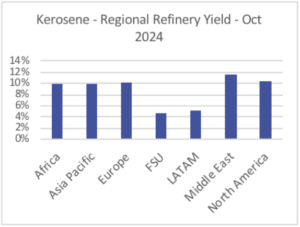

Therefore, any operator navigating through the oil complex has to put refinery margins and outputs in a regional context. Each refinery on the planet is unique by its size, its features, its complexity and its product yields (i.e. the share of a barrel of crude turned into a specific refined product). For instance, US refineries turn their crude barrels into gasoline and gasoil/diesel almost exclusively, while Middle East refineries produce relatively more heavy products such as fuel oil, but also way more kerosene/jet fuel than their LATAM counterparts.

The two main factors at play are the average crude quality processed (heavy vs light, sulfur content, various other elements naturally present in the crude…) and the typical refinery setup in the region : is it flexible enough to process a wide range of crudes ? is it complex enough to maximize yields on high margin products and minimize yields on low added-value ones ?

The normalization of global crack spreads

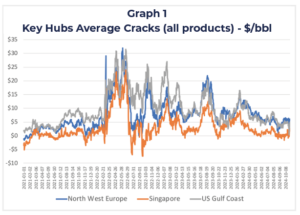

Since the 2022 energy crisis, petroleum prices have been fast and furious : extreme volatility, strong momentum patterns and heated headlines have deeply hit the market both ways. The fact that each regional hub is pretty well connected to the others, thanks to logistics capacities, amplify unfolding trends overall.

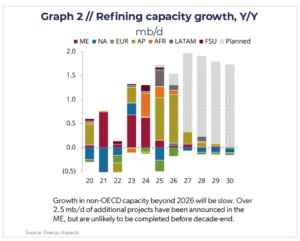

First, Western sanctions on Russian barrels coupled with a booming demand post-COVID sent refined products’ prices through the roof. Then, global balances have shifted dramatically across the barrel, as shown by the rollercoaster on cracks below [see graph 1]. Some factors have impacted spot and forward cracks globally, however, each key region display different features and dynamics.

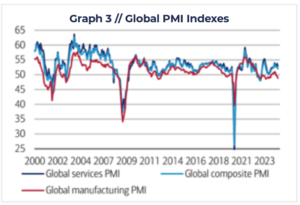

Another key driver of cracks’ normalization over the last 12-18 months is the slowdown in global manufacturing activity coupled with loosening petroleum markets. Indeed, soft economic conditions, especially in Europe and

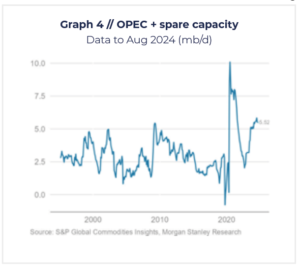

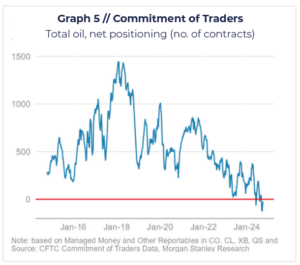

On top, despite current geopolitical tensions, spot Brent keeps trading in the $70-75/bbl range, while OPEC members are still left with total spare capacities close to 5m/d[see graph 4]. Even some OPEC members such as Iraq, Iran and Venezuela to a lesser extent increased their exports this year. Thus, oil bearishness sentiment is widely shared and felt these days, as shown by the heavy net short speculative positioning across crude and the main listed refined products [see graph 5, as of mid-october], although some length has been added on gasoline over the last few weeks. This environment does not pave the way for higher crack spreads overall.

Asian cracks under pressure

In Asia, cracks have been heavily sold off on the back of a massive slowdown in Chinese consumption this year, both on the light and middle distillates fronts. Singapore gasoline cracks (the closest reference hub) hit a record low level this year. Even jet fuel consumption (the first petroleum consumption growth engine along with NGLs/LPG) is still lagging pre-Covid highs.

Products’ inventories in the region have increased lately, showing the loosening trend in these physical markets. Moreover, recent stimulus package announcements should not have a material impact on gasoline and diesel consumption over the short term because they aim above all at restructuring local governments’ debt burden and stabilizing the Chinese property sector, stuck in deep troubles for now (the sector being so critical for China’s growth overall).

Lastly, market participants await to see to what extent Chinese refining sector, which has been partially rationalized already, will be granted (or not) an increasing number of refined product export quotas going into next year.

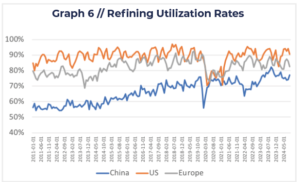

The positive margin difference between West and East on low sulfur distillates may incentivize Chinese refiners to further ramp up (local capacities currently being relatively underutilized versus the rest of the world [see graph 6]) so that they can export more petroleum products and potentially flood global markets. Again, in such scenario, crack spreads may certainly stick to lower levels for longer.

EU refining margins to remain at risk

Although European refining capacity has been frankly cut since Covid, product inventories have boomed year-on-year, especially medium and heavy distillates (such as diesel and fuel oil respectively).

Indeed, consumption is down, with Germany’s manufacturing activity being severely hit year-to-date. European refining system being pretty simple, relatively old, less flexible in terms of the variety of crude grade it can process and having a product yield tilted towards less valuable refined products, local crack spreads are bound to stay capped for quite some time. In addition, Europe is set to lower product exports to Africa with the ramp-up of Dangote refinery in Nigeria, therefore increasing gasoline availability by about 200kb/d. Coastal refineries in Europe are also due to face more agressive international competition from Eastearn (Middle East, Asia) and Western (US) barrels.

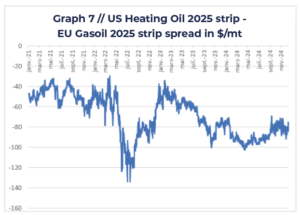

For instance, US heating oil price keeps trading forward on 2025 at discount of 82$/mt versus EU gasoil price [see graph 7], which should support US distillates exports to Europe and keep EU gasoil cracks under pressure.

US cracks to stay healthy unless consumption weakness is felt

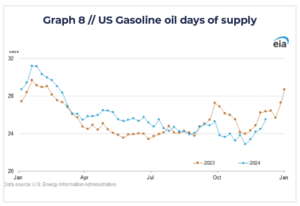

The US markets are set to remain the most profitable ones globally going froward as they rely on maxed-out run rates and cheaper crude prices (with WTI still trading at 3 to 4$/bbl discount to Brent). In addition, US gasoline inventories remain fairly low, especially when expressed in days of supply equivalent (and not simply in barrels) [see graph 8].

However, the key element for the US balance will be gasoline consumption as Americans burn between 9 and 10mb/d of gasoline (which represents almost 10% of world indirect crude oil consumption !).

Lately, a debate emerged regarding EV penetration rate in the US and its impact on gasoline consumption. International Energy Agency estimated that 2023 gasoline consumption would have been roughly 200kb/d higher if no EVs were ever sold in the US. But substitution is not the only risk : engine efficiency is another major challenge the US administration has been addressing for a while. The Corporate Average Fuel Economy program mandates minimum fuel efficiencies across automaker’s fleet. While manufacturers don’t actually need to comply with the rule and can choose to pay a penalty instead of meeting the requirements, the standards will become stringent over the coming years, implying penalties on ICE vehicles will grow (therefore lowering gasoline needs over time all else being equal).

Long term wise, should both these trends persist, US gasoline cracks should remain capped. Middle distillate demand, however, will be far less impacted with heavy-duty vehicles and aviation being far tougher to electrify.

Sources: EIA, Energy Aspects, Platts, Bloomberg, CME

Our Publications

Etienne Bossu, Chief Trading Officer at Electrum, talks to Véronique Riches-Flores, independent macroeconomist and former Chief Economist at SG CIB, about the global economic outlook and the new market paradigm. […]

EU Carbon Market 101The European Union Emissions Trading Scheme (EU ETS) is based on a cap-and-trade system: Operators of installations including power generation, various industries and intra-European aviation covered by […]