Interview with Etienne Bossu, Chief Trading Officer at Electrum

Lucrative dislocations in monetary metals markets

February 7, 2025

Reading time : 10 min

The gold market has experienced a significant dislocation starting in January 2025, driven largely by concerns about impending tariffs on US imports. This uncertainty has triggered a shift in the gold OTC forward curve, which is now back-warded in the front-end tenors, roughly up to one month maturity. In simple terms, there is a rising demand to borrow gold in London to ship it across the Atlantic to New York, as market participants brace for potential tariffs that could disrupt supply chains.

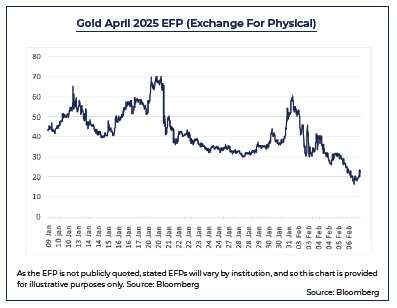

An unusual arbitrage opportunity has emerged, where traders have been able to pocket as high as $60 per troy ounce premium (” EFP “) earlier in January by shipping gold from London to New York, exploiting this price gap (versus $3-5/oz typically in normal market conditions). While not as lucrative as the $80 premium seen during the height of the COVID-19 crisis when shipping was halted, this arbitrage opportunity sent gold across the pound, from London to New York vaults, with noticeable shortages of metal building in London.

One of the most glaring signs of the evolving situation is the strain on the Bank of England’s vaults, which store gold for third parties, including financial institutions. In the past, the withdrawal process took just a few days. However, due to the increased demand, the waiting time has ballooned to between four and eight weeks, as institutions scramble to access their holdings before any potential tariff-related disruption occurs. Because of this bottleneck, gold stored at the BoE is trading at $5 discount to the rest of the loco London spot market where gold is easier to access (it compares to +/- 10-20 cents deviation in normal market conditions).

As the EFP is not publicly quoted, stated EFPs will vary by institution, and so this chart is provided for illustrative purposes only. Source: Bloomberg

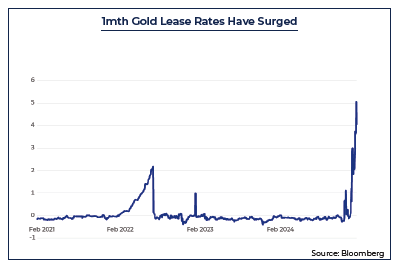

The borrowing of gold to capture the arbitrage has led to a surge in one-month lease rates, which have reached the highest levels in decades. As market participants raced to lock in the arbitrage, many have struggled to deliver the gold to New York, prompting them to close out their short positions in the COMEX futures markets. This, in turn, has exacerbated the dislocation between the futures market and the spot market, creating further price volatility and further opportunities for those able to deliver.

While there has been no official announcement of tariffs specifically targeting monetary metals, the mere threat of such measures has ignited wide-spread concern. Mexico, the world’s largest silver producer, may face up to 25% tariffs, while Canada also exports a significant amount of gold to the US. Though other countries like Australia and South Africa, are also key gold exporters, the potential additional costs associated with delivering gold into the US market are creating uncertainty and fuelling the arbitrage frenzy.

The data underscores these concerns. Since the US elections, gold deliveries to COMEX vaults in New York have surged by 393 tons, a 75% increase that marks the highest inventory levels since August 2022 according to the FT. However, this increase still falls short of the levels observed during the COVID-19 crisis. At that time, stockpiles of gold were swollen due to unprecedented demand, while much of the shipping infrastructure was in disarray.

Importantly, the current inventory increase doesn’t even account for gold shipped to private vaults, a factor that further complicates the situation. For instance, JPMorgan, the largest bullion bank, recently delivered an astounding $4 billion worth of gold to settle February contracts, highlighting the massive volume of gold shifting hands in the wake of these tariff fears.

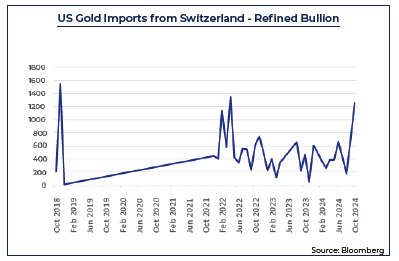

Another interesting dynamic that adds complexity to the arbitrage opportunity is the difference between gold bars stored in London and those that are acceptable in COMEX vaults in New York. These bars are not interchangeable without proper certification or refinement. Gold bars in London (often in the standard 400-ounce London Good Delivery form) need to be transformed into bars that meet COMEX’s specific standards (100oz or kilobars), which requires the intervention of refineries (mainly in Switzerland). This added complexity makes it more difficult for traders to secure the premium without incurring additional costs.

Further proof of the growing market tension comes from the latest figures from Swiss Federal Customs, which show that gold exports to the US spiked towards the end of December 2024, reaching levels comparable to those seen during the COVID-19 crisis and the Russia-Ukraine war. This surge in exports suggests that traders and investors are increasingly focused on getting their gold into New York before any potential tariffs are implemented.

Ongoing dislocations can be made ongoing dislocation in the gold market serves as a stark reminder of the unpredictable nature of geopolitical risks and trade uncertainties. The looming threat of tariffs on imports into the US, combined with the complex logistics of moving gold between London and New York, has created an environment where arbitrageurs are scrambling to capture any price gaps, driving both gold prices and inventories to extreme levels. How the situation unfolds will depend largely on the timing and scope of any tariff measures, but for now, it’s clear that the gold swap market is facing one of its most volatile periods in recent memory.

Similar observations can also be seen in the silver market, with similar arbitrage opportunities and logistical challenges emerging. A normalization in both the gold and silver markets could occur if the US administration clearly states that monetary metals will be exempt from tariffs or if central banks take advantage of the attractive leasing rates to lend their gold, which would help ease the dislocations over time. Until then, market participants who have control over the entire supply chain will continue to move gold to New York, but the resolution of these dislocations will likely be a gradual process.

Our Publications

Etienne Bossu, Chief Trading Officer at Electrum, talks to Véronique Riches-Flores, independent macroeconomist and former Chief Economist at SG CIB, about the global economic outlook and the new market paradigm. […]

EU Carbon Market 101The European Union Emissions Trading Scheme (EU ETS) is based on a cap-and-trade system: Operators of installations including power generation, various industries and intra-European aviation covered by […]