Interview with Etienne Bossu, Chief Trading Officer at Electrum

The unpredictable realm of commodity trends

July 4, 2024

Reading time : 10 min

TRADERS TANGO

Commodity traders engage in buying and selling commodities in their simplest form (i.e. physical underlying) or more complex methods through derivatives contracts, sometimes with exotic payoffs. Commodities encompass a wide range of physical goods, including metals, energy products, agricultural products, and livestock. Traders in this field can be broadly categorized into hedgers and investors. Hedgers seek to mitigate volatility risks by locking in prices, while investors aim to profit from price movements without necessarily intending to take physical delivery of the commodities.

At Electrum, we participate in both hedging and investing strategies through our comprehensive business activities. Our hedges are implemented on the back of prepayment & offtake contracts that finance various producers globally, taking the physical delivery and selling it in financial markets. On the investment side, we deploy a sophisticated blend of discretionary and quantitative decision-making processes, allowing us to capitalize on market opportunities.

Electrum was founded with a focus on trading precious metals, specifically gold, silver, platinum, and palladium. Our expertise in these markets was built on nearly a decade of success. Recently, we have expanded our trading capabilities to include other commodities, starting with metals that are by-products of gold, such as copper, nickel, lead, cobalt, and zinc. This strategic expansion allows us to leverage our existing knowledge and infrastructure to manage a broader range of metals effectively. Besides metals, we are diversifying our scope to include energy and agricultural products. By entering these markets, we aim to transform Electrum into an all-encompassing trading house.

As traders, we must of course understand what drives the market starting with its core fundamentals. Above all, comprehending how these drivers may change over time is paramount. In other words, determining how long a trend will last is equally as important as forecasting its occurrence in the first place. It is crucial to recognize emerging patterns and their potential impact to adapt our strategies and stay afloat in the complexity of financial markets. The commodity market changes rapidly and frequently, necessitating a proactive approach to mitigate inherent risks associated with price volatility. At Electrum, we obey strict risk management rules to protect against losses through a combination of stop loss orders, portfolio hedging techniques and statistical models to predict worst case scenarios. Nonetheless, adeptly riding favourable trends in the right direction can yield significant opportunities for profit.

MODERN DAY MARVELS

From ancient civilizations to modern industry, the journey of precious metals has been nothing short of remarkable. Discovered and treasured by early cultures for their beauty, these metals have transcended time, evolving from symbols of wealth and power to critical components of the modern technological world. Today, precious metals are also driven by innovation and adaptation, as they continue to play a vital role in shaping our economy thanks to their unique physical and chemical properties.

Among the uses of precious metals, the timeless appeal in fine jewellery stays strong. Jewellery remains the largest source of annual demand for gold, accounting for around 50% of the total, despite a decline in recent decades.

India and China are the leading consumers, together accounting for more than 55% of the total jewellery demand, according to 2023 data from the World Gold Council. The cultural and historical significance of gold in these regions, particularly for weddings and festive occasions, largely explains the stunning request for the metal. Similarly, silver plays an important role in the industry but in the form of sterling silver, an alloy composed of 92.5% silver and 7.5% copper. The reason not to use silver in its purest form is that it is too soft for practical use. Sterling silver is popular for its affordability as well as versatility which make it a good material for everyday wearing. Platinum and palladium also have a significant jewellery demand, respectively accounting for 30% and 28% of the total. Platinum is renowned for its strength, hypoallergenic properties, and ability to hold gemstones securely, making it a preferred choice for engagement rings and fine jewellery. Finally, Palladium, known for its lustrous finish and durability, has gained popularity in recent years, particularly in the creation of white gold alloys, which provide a bright, white appearance that is highly sought after in contemporary jewellery design.

Beyond jewellery, precious metals have a multitude of other uses linked to the real-economy that might be less under the spotlight but are equally important. Gold for instance has an extended demand coming from the technology sector, particularly the electronics one which accounts for 80% of the total. This high demand is due to gold’s excellent conductivity, malleability, and resistance to corrosion, making it ideal for creating intricate circuits and memory chips as well as cables, wires and telecommunications equipment. To put it into perspective, the average amount of gold contained in a smartphone is 0.034 grams. The expected growth in AI-related devices and infrastructures is anticipated to further drive demand for gold in this sector. Indeed, AI systems, with their reliance on powerful computing hardware, are one of the top beneficiaries of gold’s superior characteristics. Additionally, the trend toward electrification in various industries is supporting a growing demand. Electric vehicles, for instance, use gold-plated connectors and terminals to ensure efficient power transfer and reliability. Beyond electronics, gold finds applications in less-known areas such as space exploration and wearable diagnostic tests. It is used for shielding spacecraft from infrared radiation and heat, ensuring the protection of sensitive equipment, and for diagnostic kits, including those for COVID-19 antigen and antibody tests, due to its reliable and precise performance. Because of the similar properties, Silver is equally used in the aforementioned industries. Particularly interesting is the utilization of the grey metal in the photovoltaic and photography businesses. In photovoltaic cells, silver is used to create conductive pathways, known as silver paste, which collects and transports the electrical charges generated when sunlight strikes the silicon cells.

The excellent conductivity properties of silver allow for the maximization of the energy conversion efficiency of solar panels. This is the greatest use of silver in electrical and electronics category. Following the advent of digital photography, the use in this area has diminished but there is still a solid demand just above 25 million ounces a year. Its scope is within halide crystals, a chemical compound formed by silver and one of the six halogens, used for professional and artistic photography.

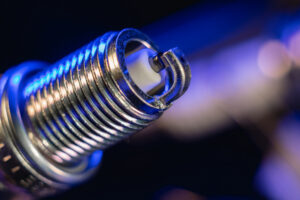

Concerning platinum, one of the most extensive industrial uses besides jewellery is related to the automotive industry. This segment is the largest absorber of platinum supply, estimated to contribute roughly 30 to 45% of the total demand. Platinum is a key component of catalytic converters, devices found in almost every gasoline or diesel engine. These converters are essential for

reducing vehicle emissions by converting toxic gases and pollutants, such as carbon monoxide, into less harmful substances like carbon dioxide and water vapor. Platinum’s exceptional resistance to high temperatures and its catalytic properties make it ideal for this application, as it remains stable and effective even under the intense heat of exhaust systems. Beyond its critical role in catalytic converters, platinum is also used in the production of fuel cells, which generate electricity through the electrochemical reaction of hydrogen and oxygen. Because of its emission reduction role, platinum is pivotal in the green transition. Palladium is also widely used in the automotive industry – around 80% of the total demand – with the difference that it is highly effective at lower temperatures. As the two are closely replaceable, car manufactories oscillate between the two depending on their cost and availability.

MONEY METAMORPHOSIS

The value of precious metals extends far beyond jewellery shop windows and factories walls. Precious metals have garnered interest well before the implementation of the gold standards with the first coin made of gold dating from the 6th Century BC. Among precious metals, gold stands out as a premier investment vehicle with its value internationally recognized and benchmarked primarily by the London Bullion Market Association. Unlike many commodities, gold’s trading patterns are often driven more by investor sentiment than traditional supply and demand dynamics, as the significant existing reserves of above-ground gold far outweigh new mining outputs. Therefore, given its characteristic of holding value and low correlation with other financial asset classes, gold is most sought in periods of financial distress. Indeed, gold has hedging financial properties thus preserving wealth against inflation, weakness in fiat currencies and geopolitical risk. Gold works as a diversification instrument, and purchases of the metal were the most notable development in FX reserve management over the last years. China is a typical example of that, with the country notably increasing its reserves since 2015. However, the United States of America remains the country with the largest gold reserve. Germany and Italy follow in the standings, being the largest holders in the old continent. The diversification property is very evident when the US equity and bond markets are positively correlated. Indeed, a classical balanced portfolio 50/50 will be outperformed by a 75/25, where 25 represents the gold allocation. This diversification can be achieved by purchasing gold as physical, bars, coins, ETFs and derivatives products. Interestingly, equity portfolio managers whose investing mandate is limited to equity only, sometimes achieve this diversification benefit by purchasing listed shares in gold producers as a proxy to gold. More recently, we have seen silver gaining interest as a store of value but its volatility (which is about twice as large as gold) continues to deter investors. Meanwhile, Platinum and Palladium remain largely dominated by industrial flows and fail to work as safe havens for investors.

Commodities have been a hot topic for some time now, particularly following the surge in Q1 2024 and gold spiking to new all-time high. Several events in recent years, including rising inflation, tight monetary policy, and escalating geopolitical tensions, have fundamentally altered the market environment and shifted the priorities driving commodity prices. In the context of gold, an important monetary regime change could be on the horizon. This potential shift is largely attributed to the significant accumulation of gold by central banks worldwide, which is believed to be a key factor behind the recent price increase. Despite rising real interest rates, a persistently hawkish stance from central bankers, and moderate participation from Western investors, gold prices have continued to climb. This momentum was also supported by substantial purchases from Chinese and Indian retail investors but only moderately by western investors. Should the latter participate in the buying action, an additional price upward pressure could be generated. Additionally, the geopolitical landscape provides a strong tailwind for the yellow metal.

Ongoing tensions in the Middle East, the protracted conflict in Ukraine, rising concerns over Taiwan, not to mention political elections in Europe, the UK and the US contribute to a climate of uncertainty that typically benefits safe-haven assets like gold. The situation is also compounded by the potential for further trade tariffs or regulatory restrictions (e.g. Trump Election, Western sanctions on Russian exports etc.). Moreover, the global economic outlook remains cloudy, with softened but still present fears of a recession and uneven recovery development path for worldwide economies.

Yet the GSCI is only moderately up (+9.43% YTD) this year despite sky rocketing gold (+12% YTD), cocoa (+96% YTD), copper (+11.5% YTD) prices. This points to the idiosyncratic nature of commodities rather than a general rising market. Overall, the consensus outlook for commodities stays structurally bullish but the dynamics at play are definitely complex and bulls are often disappointed (e.g. Chinese recent destocking tempered Copper bulls). Timing the trends is very difficult as it has important consequences on risk management. Much of the road ahead will be defined by how economic activity responds to monetary policies and how quickly interest rates will adjust. As traders we must find the subtle balance to express a conviction or signal while staying in position long enough. In a market where implied volatility is trending lower but exposed to sudden spikes of realized vols, the investment process often resembles an art more than a science.

PARTING THOUGHTS

The realm of commodity trading is a complex and dynamic landscape, requiring a deep understanding of market fundamentals and the agility to adapt to rapid changes. At Electrum, our dual focus on hedging and investing, supported by robust risk management strategies, positions us to navigate these fluctuations effectively. Our expansion into diverse commodities and markets reflects our commitment to leveraging expertise for broader opportunities but, as we continue to grow, the ability to recognize and act on emerging trends will be crucial. The ever-changing nature of commodities demands a proactive approach, combining thorough analysis with strategic foresight to achieve lasting success.

Our Publications

Etienne Bossu, Chief Trading Officer at Electrum, talks to Véronique Riches-Flores, independent macroeconomist and former Chief Economist at SG CIB, about the global economic outlook and the new market paradigm. […]

EU Carbon Market 101The European Union Emissions Trading Scheme (EU ETS) is based on a cap-and-trade system: Operators of installations including power generation, various industries and intra-European aviation covered by […]