Interview with Etienne Bossu, Chief Trading Officer at Electrum

Precious considerations around Gold Hedging

December 5, 2023

Reading time : 10 min

It is certainly topical for gold producers to revisit their approach to hedging when 1y gold forward price reach new all-time highs. In 2023, gold producers had an opportunity to commit to sell their future production at close to $2100/oz and attractively secure high margins which is crucial in a rising cost of financing environment.

Typically, hedging allows corporates to lock-in a certain rate for financial assets they are exposed to and thereby reduce uncertainty and gain visibility on their future cash flows. A common and simple practice for gold producers involves selling future gold production at a fixed price to lock in guaranteed revenue in the future, using a forward in the OTC market or a future contract in the listed market (COMEX).

The natural beauty of contango curves!

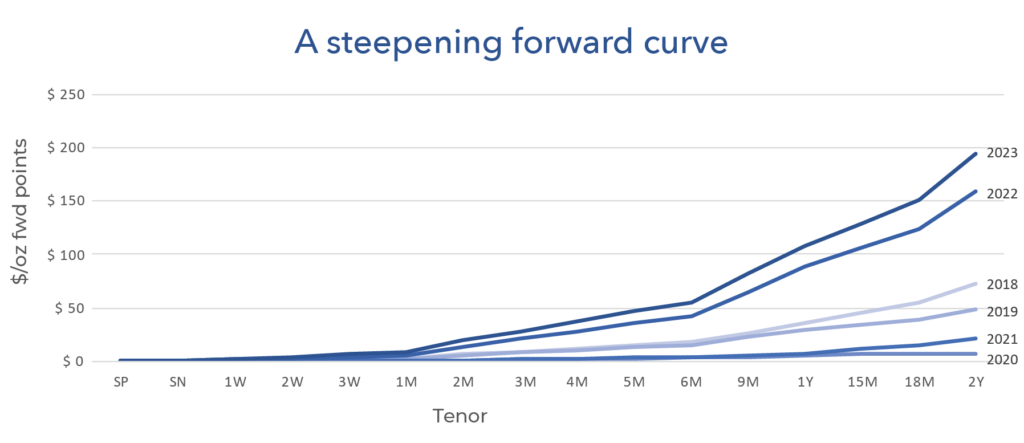

Hedging Gold future production is optically attractive because its forward curve is in contango meaning that forward prices are trading at a premium (above) to spot. This is partly due to costs associated to gold storage (think insurance and security). Gold holders must be compensated for these costs incurred on behalf of those deferring its collection to a future date. While inflation has certainly driven some of these costs higher, the bulk of the ongoing steepness of the forward curve results from the increased interest rate differential between Gold and USD interest rate as the Fed embarked in an aggressive hiking cycle. Meanwhile, in the absence of monetary authority setting interest rates for precious metals, gold lending rates reflect supply and demand dynamics. Given the large amounts of gold stored in central banks vaults supply greatly exceeds demand and this perception mostly prevent gold rates from spiking above US rates and the market is therefore in contango.

The notion of contango makes virtually every financial instrument look attractive to the hedger who is looking to forward sale its production. The current combination of high Gold spot rate (>$2000/oz) and very steep Gold forward curve (1y > 5.5%) means that producers had the opportunity to lock in unprecedentedly high forward gold prices in 2023, thereby strongly boosting their operating margin.

Yellow fever may have caused hedging sickness?

Yet, Evolution Mining, one of the largest Australian gold producers announced in March 2023 they would not hedge from June 2023 onwards while rival producer Northern Star is 25z-55% hedged out to 4 years. It comes in stark contrast to the 90s when Australian gold miners where the most hedged (sometimes with hedge ratios greater than 100%) followed by north Americans. Back then, gold was in a secular bear market. But no one wants to be hedged in bull markets when gold rallies, especially as market participants tend to turn even more optimistic (“the yellow fever”). The infamous gold hedging induced collapse of Ashanti in 1999 or the eyewatering $4bn cost of unwinding hedges at Barrick in 1996 has likely discouraged some miners from protecting their revenue. The heterogenous approach currently observed in the industry underlines that the purpose of hedging continues to be debated nearly 30y later.

Reasons for hedging avoidance often stem from the lack of understanding of active risk management methods. Corporate top management may see it as outside of core business (exploring, mining, refining) and believe risk cannot be measured accurately (especially currency risk). Establishing and managing hedging positions does introduce a layer of complexity (such as exposure to margin calls) which requires a dedicated team and infrastructure (Portfolio management system, valuation tools, collateral posting, risk metrics etc). While derivatives trading may be well outside management’s field of expertise, it is suboptimal to simply turn a blind eye. Firstly, because not proactively managing market risk is already quite speculative in nature. Secondly, because hedging reduces uncertainty of future cash flow and increases financial visibility. Steady cash flows enhance credit quality and therefore reduces cost of debt financing.

The delicate balancing act of hedging!

Before you start delving into the realm of derivatives, look for natural hedges. If your operation is capital intensive you may want to raise gold linked capital such as set price prepayment contracts (equivalent to debt). Part of your future production will be sold at a discounted price fixed today and your future performance will be less sensitive to gold spot price. With a prepayment contract, the exposure to price fluctuation is transferred to the USD lender.

Obviously, as with any type of hedge, it would be unreasonable to commit more than 100% of your production. Hedging less than 100% allows businesses to retain operating flexibility in case of future adverse production conditions. It also allows to retain financial flexibility if gold linked financing is contemplated (for which unencumbered production is required) or simply to benefit from surging attractive market conditions (high gold spot price and higher margins). Typically, we observe that gold producers’ hedge ratios range between 15 and 60% for gold producers and they hedge 1-3y worth of production. In practice, liquidity dries up quickly beyond 1y for most hedging instruments and transaction cost becomes prohibitive. Sporadically, hedge ratio may increase to 100% at times of elevated capex or indebtedness when the need for financial visibility is exacerbated.

Hedging should be calibrated to protect operating margins and not revenues because they do not encompass the portion desensitised to gold thanks to natural hedges. Where possible, instruments should be kept to forwards, plain vanilla options to obtain the appropriate cash-flow hedging treatment and avoid unnecessary noise in income statements.

Finally, hedging systematically over a fixed tenor offers visibility on the hedge rate but merely postpones the impact of spot fluctuation by the hedged tenor. A simple and often overlooked alternative method consists in layering hedges. One gradually increases hedge ratio by transacting a portion of the total exposure from one period to the next. This way the hedge rate for a given cash flow will result from the average entry point over the total hedging period. The method still offers visibility but also improves variability in the achieved hedge rate from one period to the next.

Reducing revenue sensitivity to gold may sound like a good idea if you look to secure credit and protect future revenues from falling gold prices. It may, however, go against the investment thesis of your shareholders if they bought your stock as a high beta investment to gold for speculation or for portfolio diversification purposes. Therefore, it is crucial to design a hedging strategy considering all stakeholders’ best interest.

Dynamic Hedging!

At Electrum, we invest in our people and infrastructure because efficient hedging is part of our DNA. Our strategies are aligned with our shareholders’ objectives in full transparency. We constantly adapt our hedging strategies to market conditions. Our experienced team of traders and quants carefully monitor all market parameters and structure a variety of linear and non-linear products to manage our evolving exposure. We balance protection and participation objectives by taking measured risk fitting our market views. We developed quantitative models which coupled with our analysis of macro-economic developments, enrich our decision process. We believe a hedge does not need to be necessarily static throughout its life. We dynamically restructure our hedge book when come the right opportunities to extract additional value. Among other best practices, we also multiply our dealing counterparties to exercise price tension, we allocate trades where we maximize capital efficiencies and reduce our counterparty default risk.

Hedging can be tactical, focusing on the short term while a high capex project is being completed or fixed costs are being reduced. It can be strategical, focusing on the longer term to increase chances of survival in tail risk events (if gold spot falls below high AISC). In any case, hedge ratios ranges should be defined (e.g. minimum 30% – maximum 60%) and hedging instruments (forwards, purchased options, collars…) pre-determined for various market scenario. The art of hedging can be very powerful to efficiently run a business in serenity if its design and deployment is carefully planned.

Our Publications

Etienne Bossu, Chief Trading Officer at Electrum, talks to Véronique Riches-Flores, independent macroeconomist and former Chief Economist at SG CIB, about the global economic outlook and the new market paradigm. […]

EU Carbon Market 101The European Union Emissions Trading Scheme (EU ETS) is based on a cap-and-trade system: Operators of installations including power generation, various industries and intra-European aviation covered by […]