“The Big Long.” That is the title of the latest “In Gold We Trust” report published by the Asset Management company Incrementum following a large number of interviews with leading […]

EUAs: pump it up

April 24, 2025

Reading time : 10 min

EU Carbon Market 101

The European Union Emissions Trading Scheme (EU ETS) is based on a cap-and-trade system: Operators of installations including power generation, various industries and intra-European aviation covered by the EU ETS must surrender an EU Allowance (EUA) for each tonne of CO2 emitted in the previous year. A fraction of these quotas is distributed for free to the most carbon-intensive industries (called “free allowances”). This amount keeps decreasing every year as the objective is to reduce carbon emissions. The remaining majority is allocated through auctions via the European Energy Exchange (EEX) for primary auctions. Paper futures and options markets trade on ICE Futures Europe but also widely in OTC. Companies covered by the EU ETS that do not receive free allowances, or whose emissions exceed their free allocation, are required to purchase EUAs via the OTC or listed market.

Historical perspectives

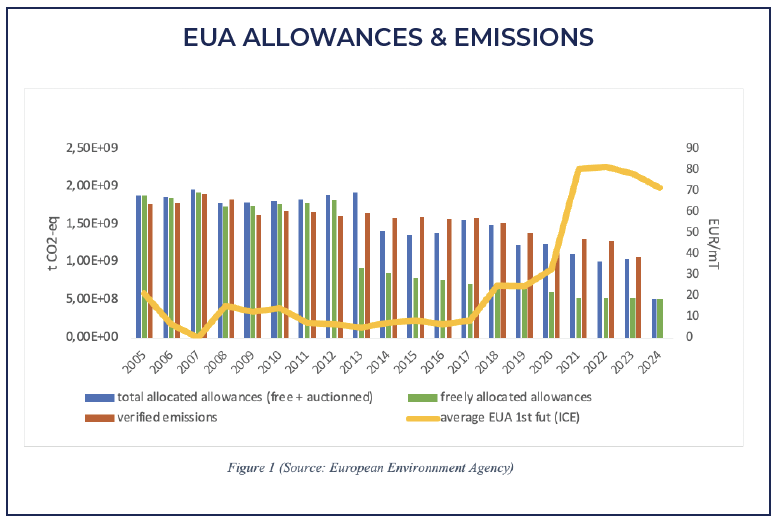

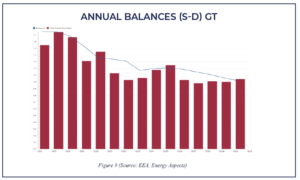

Since the launch of the EU ETS in 2005, the balance between EUA allowances and verified emissions has evolved significantly. During Phases 1 and 2 (2005–2012), total allocations systematically exceeded emissions, leading to a cumulative surplus of over 2 billion EUA and low prices, often below €10/t, collapsing near zero in 2007. In Phase 3 (2013–2020), the cap was tightened and auctioning increased, but the historical surplus kept prices around €5–8/t until 2017. A structural shift occurred from 2019 with the implementation of the Market Stability Reserve (MSR), withdrawing over 400 million allowances annually, and a stricter annual cap reduction of 2.2%. As shown in Figure 1, this resulted in a progressive convergence between verified emissions and total allocations. Combined with growing climate ambition, this tightening led to a price rally, with EUA prices rising from €25/t in 2019 to above €90/t by 2022, reflecting the move towards a structurally tighter market.

Dancing with the fuel switch: carbon, gas and coal markets are tied

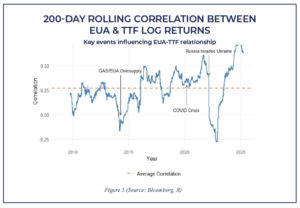

The recent dynamics between EUA and EU Gas, namely the TTF hub, highlight shifting correlations driven by energy fundamentals, market positioning and geopolitical risks. Historically, this correlation has fluctuated, reflecting Europe’s dependence on gas and coal for power generation. As shown in Figure 3, the correlation weakened around 2014 due to structural oversupply in both the gas and carbon markets and stayed low until the tightening of EUA supply in 2017 and 2019.

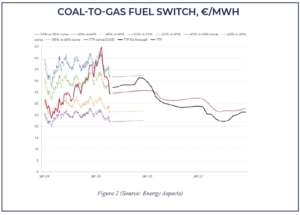

EUA and TTF prices are fundamentally linked through fuel-switching economics. In 2024, gas accounted for 15% and coal for 10% of EU electricity production. When gas prices rise, coal becomes more competitive, increasing EUA demand and prices. Conversely, low gas prices support gas burn, reducing carbon intensity and EUA demand. Figure 2 illustrates these switching levels for various power generation efficiencies. In early 2025, TTF prices hovered at or above key coal-to-gas switching thresholds, increasing coal competitiveness and driving up EUA demand.

The sharp correlation breakdown in 2022 followed Russia’s invasion of Ukraine, triggering gas supply disruptions and extreme price volatility. EUA-TTF correlation turned negative as carbon prices decoupled from gas due to falling industrial demand, high inflation and macroeconomic uncertainty. This breakdown marked a temporary regime shift in the relationship.

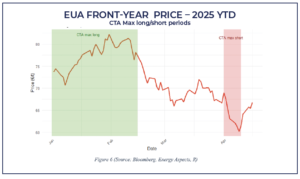

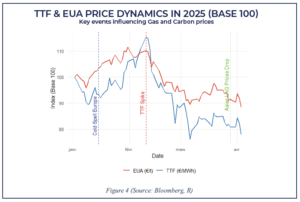

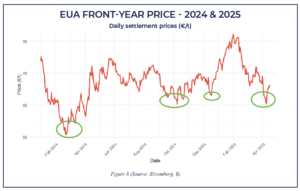

In late 2024 and early 2025, correlation increased again, supported by colder-than-expected weather, stronger thermal generation, and speculative positioning. EUA prices rallied from €66 to €85 in January before retracing below €70 in early March. Figure 4 highlights key events during this period: a cold spell in January, a TTF price spike in February, and a sharp drop in Asian liquified natural gas (LNG) spot prices in March, which added downward pressure on TTF.

Strong positioning shifts increase volatility

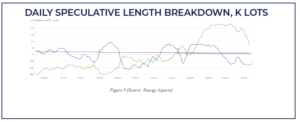

Systematic funds like Commodity Trading Advisors (CTAs) play an increasingly important role in the carbon market, especially when prices start to trend. These funds don’t trade on fundamentals but follow price signals such as moving averages or breakouts to decide when to buy or sell. When EUA prices break higher, CTAs often pile in and add momentum to the move. The same dynamic applies during sharp selloffs. This was clearly the case in late February 2025, when CTAs flipped from long to short as momentum reversed, adding significant pressure on prices. Their activity can fuel strong moves in both directions, making it essential for traders to monitor positioning and momentum signals closely.

Despite macro uncertainty, compliance buyers step in

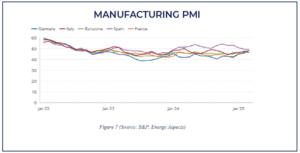

Macro uncertainty remains a major downside risk to carbon prices. Slower global and European growth (see Manufacturing PMI in Figure 7) directly reduces energy consumption and industrial activity, which in turn lowers emissions and demand for EUAs. With inflation still sticky and the policy cycle turning, downside risks to both GDP and energy use remain high keeping EUA demand fragile despite seasonal drivers.

What’s ahead? EU gas storage refilling season and deficit in Q4 25 onwards

Looking ahead, the upcoming EU gas storage refill season and expectations of a storage deficit from Q4 2025 onward will be key drivers for both TTF and EUA prices. With storage levels currently low, end-of-year TTF prices will need to rise meaningfully above summer levels to incentivize injections. This is because gas injections into storage typically occur when there is a profitable spread between lower summer prices and higher winter prices. If the summer-winter price spread is too narrow, storage operators and utilities have little financial incentive to inject gas during the low-demand summer months. A strong rally in end-of-year prices would restore that spread and help support adequate storage levels going into the winter season. This upside risk in gas could provide meaningful support to EUA prices over the coming months.

Coal markets remain mixed. On one hand, US supply could re-enter the market and weigh on prices. On the other, China’s stimulus measures may increase medium-term coal demand, tightening global balances and indirectly act as an headwind for EUA prices. At the same time, switching thresholds along the forward curve remain relevant, as gas remains structurally more competitive in the near term.

Further out, the EUA balance becomes tighter. This should first help stabilize prices at current levels, before laying the groundwork for a potential rebound. Speculators are beginning to rebuild long exposure, CTAs have returned with buying interest following the recent lows around €60, compliance demand is picking up, and overall allowance supply is expected to continue to shrink. Together, these dynamics suggest the downside is increasingly limited, while upside potential builds into year-end and beyond.

Sources: Energy Aspects, Bloomberg, European Environnement Agency, S&P

Our Publications

Interview with Etienne Bossu, Chief Trading Officer at Electrum

Etienne Bossu, Chief Trading Officer at Electrum, talks to Véronique Riches-Flores, independent macroeconomist and former Chief Economist at SG CIB, about the global economic outlook and the new market paradigm. […]