“The Big Long.” That is the title of the latest “In Gold We Trust” report published by the Asset Management company Incrementum following a large number of interviews with leading […]

Gold: the drivers of the current bullish supercycle remain intact

July 15, 2025

Reading time : 10 min

“The Big Long.” That is the title of the latest “In Gold We Trust” report published by the Asset Management company Incrementum following a large number of interviews with leading operators throughout the gold value chain (mining companies, traders, etc.). The report finds that the current economic and geopolitical turmoil is profoundly transforming the international monetary system and putting gold firmly back at the center of attention. At the crossroads of a cycle of price instability, rising public debt, and shifting geostrategic balances, the precious metal is more than ever a strategic asset. Let’s review the report’s findings.

The continuing rise in public debt in the United States, the threat of the dollar losing its status, trade tensions and the risk of a trade war are the major shocks currently affecting the global economy. The arrival of Donald Trump in power marks a turning point, with a desire for reindustrialization under tariff protection, a renegotiation of the role of the dollar, and a return to less orthodox fiscal policy. Added to this are a loss of fiscal discipline in Europe (as shown by Germany’s U-turn), the rise of China, and the gradual decoupling of the major powers.

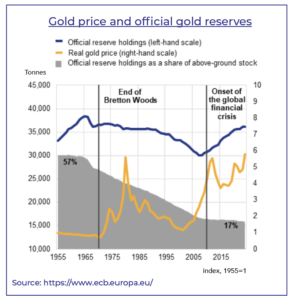

These changes are paving the way for a new era of “monetary climate change”: the old monetary system based on debt and confidence in the dollar is becoming increasingly fragile. In the long term, this dynamic could lead to an overhaul of the global monetary system, similar to a new Bretton Woods, in which gold would once again become an essential anchor. “Central banks now hold almost as much gold as they did in 1965,” notes Etienne Bossu, head of trading at Electrum.

Inflation, interest rates, and the role of gold

In this uncertain environment, inflation and monetary cycles play a key role. Despite temporary disinflation, the risk of a second inflationary cycle remains high, particularly in the event of monetary or fiscal stimulus in response to economic slowdowns. The Federal Reserve, under pressure from a slowing US economy and a growing deficit, could be forced to lower rates well beyond current expectations. Historically, such easing has led to an appreciation of gold. “If the Fed is forced to lower rates while inflation remains persistent, investor confidence in the US dollar will continue to deteriorate, benefiting gold.”

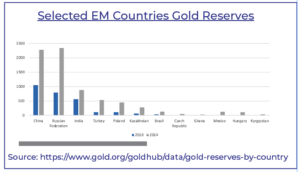

At the same time, growing mistrust of fiat currencies and the specter of a too strong or too weak dollar (the famous “Triffin dilemma”) are prompting central banks to strengthen their gold reserves. Since 2022, gold purchases by central banks – particularly in Asia, Russia and other emerging countries – have intensified, reflecting the need for a liquid asset with no counterparty risk that is not subject to the political decisions of any given country.

Short- and long-term outlook for gold

In the short term, the bullish rally in gold, marked by a succession of new historic highs, could see a correction. This decline could be fueled by profit-taking, temporary geopolitical easing, a rebound in the dollar, or a decline in demand from central banks. “Nothing goes up in a straight line” says Etienne Bossu, noting that “pullbacks towards $3,000 will be opportunities to strengthen fundamental positions.”

In the long term, however, the fundamentals of a bullish supercycle remain intact. The transition to a new monetary architecture, the diversification of institutional portfolios, the structural increase in global money supply, and the loss of credibility of sovereign debt are all factors that favor continued appreciation. Estimates based on shadow gold price models or inflation/stagflation projections suggest a target of between $4,800 (base scenario) and up to $8,900 per ounce by the end of the decade.

Gold and its derivatives: the “Big Long”

Beyond gold itself, the bull cycle is spreading to peripheral assets: silver, mining stocks, and strategic commodities. Historically, these asset classes outperform gold at the end of the cycle, offering additional return potential for holders of a well-diversified portfolio. “While gold is a good natural diversifier for traditional equity and bond portfolios, a basket of well-selected commodities will better absorb inflation shocks.”

In summary, Incrementum’s study suggests that gold is the main beneficiary of the current macroeconomic upheavals. At a time when multilateralism is weakened, global trade is under pressure and monetary policy is more interventionist than ever, the precious metal combines a store of value, protection against inflation and a hedge against geopolitical shocks. In the short term, volatility remains, but in the long term, gold is the linchpin of a new cycle of prosperity based on scarcity, neutrality, and liquidity.

Our Publications

Interview with Etienne Bossu, Chief Trading Officer at Electrum

Etienne Bossu, Chief Trading Officer at Electrum, talks to Véronique Riches-Flores, independent macroeconomist and former Chief Economist at SG CIB, about the global economic outlook and the new market paradigm. […]